Simplifying Consumer Duty for Debt Collectors: 3 Solutions to Key Challenges

Published: Jul 3, 2025

Publications

The FCA’s Consumer Duty brought in a significant shift in expectations for financial services firms, including those in debt collection. The new regulation sets out key guidance for the fair treatment of customers and demands evidence of proactive, measurable support, especially for those in vulnerable circumstances. Consumer Duty for Debt Collectors presents both a challenge to the status quo and an opportunity that could transform their effectiveness and success. Getting Consumer Duty right can improve customer engagement, lead to better outcomes, and even help secure new business.

What to know how?

Three key challenges of Consumer Duty for Debt Collectors, with practical solutions:

1. Identifying customers with characteristics of vulnerability

The challenge:

Consumer Duty requires firms to identify customers with characteristics of vulnerability, while debt collectors can assume a level of financial vulnerability, it’s not the whole story. We’ve found people tend to be experiencing an average of seven different vulnerabilities, many which are intrinsically linked – debt with poor mental health or addiction for example, or following a sudden bereavement. Research by Money and Mental Health shows that half (46%) of people in problem debt also have a mental health problem.

The solution:

Use data-driven tools like digital wellbeing checks to understand individual vulnerabilities, such as poor mental health, addiction, bereavement or domestic abuse.

2. Creating processes that encourage customers to disclose

The challenge:

Many customers avoid engaging with debt collectors due to fear, shame, or mistrust. They screen calls, stop opening letters and don’t answer the door.

The solution:

Offer safe, stigma-free channels for disclosure. We’ve found customers are far more likely to disclose digitally and to a third party, than to the company they have debt with. Our B Corp certified digital wellbeing checks don’t talk about arrears, we simply ask the customer if they are okay and offer simple yes/no questions for customers to share their situation. By aligning with a recognised social good provider, you can reframe your brand as part of the solution, overcoming some of the negative perception of debt collection (and giving your brand a point of differentiation when it comes to marketing).

3. Designing support that meets real needs and reduces operational risk

The challenge:

Support can only be effective if it reflects the actual vulnerabilities and circumstances of your customers. A generic one-size-fits-all approach won’t meet the FCA’s expectations. With the insights collected from solutions 1 and 2 – this is where you can make a real difference. Both to customers and your company by reducing risk around complaints and preventing foreseeable harm.

The solution:

Use insights gained from disclosure to ensure your contact team is trained in the key areas needing support. Plus create processes to connect customers with relevant support. Whether it’s help with housing, mental health, or budgeting; link individuals to services that can help them stabilise their situation to reduce the risk of harm and in turn increase the chance of repayment. Create partnerships directly with relevant third sector or charity organisations.

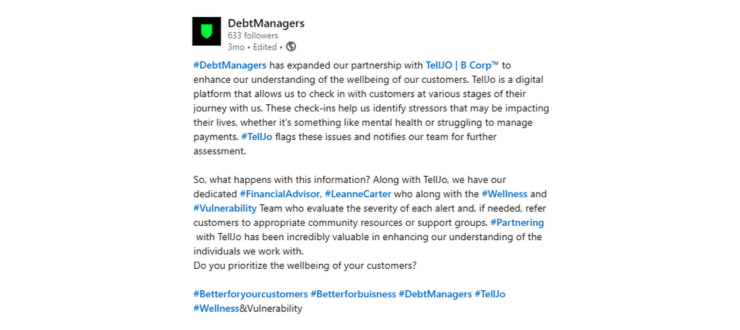

For example, DebtManagers (New Zealand and Australia) use TellJO’s digital wellbeing checks as their first piece of communication (after the initial contact communication) allowing customers to tell their story and for DebtManagers to be human in their response. See the full post here.

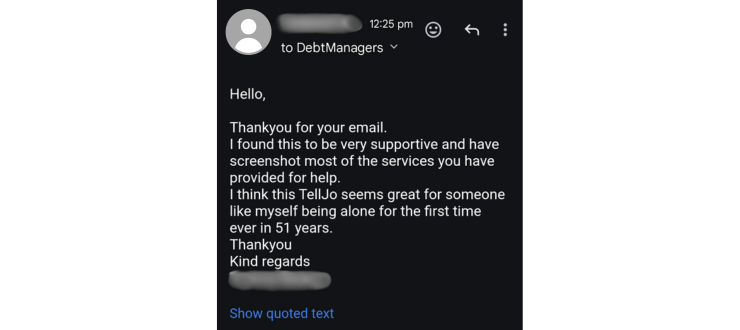

Customers appreciate it too:

Bonus: Why getting Consumer Duty right will win you business

Complying with Consumer Duty isn’t just about avoiding regulatory risk. It will also help you win contracts. Financial services firms must demonstrate that and firms they work with treat vulnerable customers fairly. Having a transparent, outcome-driven process for the identification and fair treatment of vulnerable customers will give you a competitive edge.

Final thoughts – Consumer Duty for Debt Collectors is an opportunity

With Consumer Duty, compliance doesn’t have to come at the cost of performance. For example, customers who receive a digital wellbeing check are five times more likely to enter a payment plan compared to a standard collections SMS, and are less likely to fall deeper into financial difficulty.

In fact, our clients in the debt collection industry have generated up to 500% ROI through increased payment arrangements.

See what we could do for you. Email dominic.maxwell@telljo.org or contact us here.